45l tax credit requirements

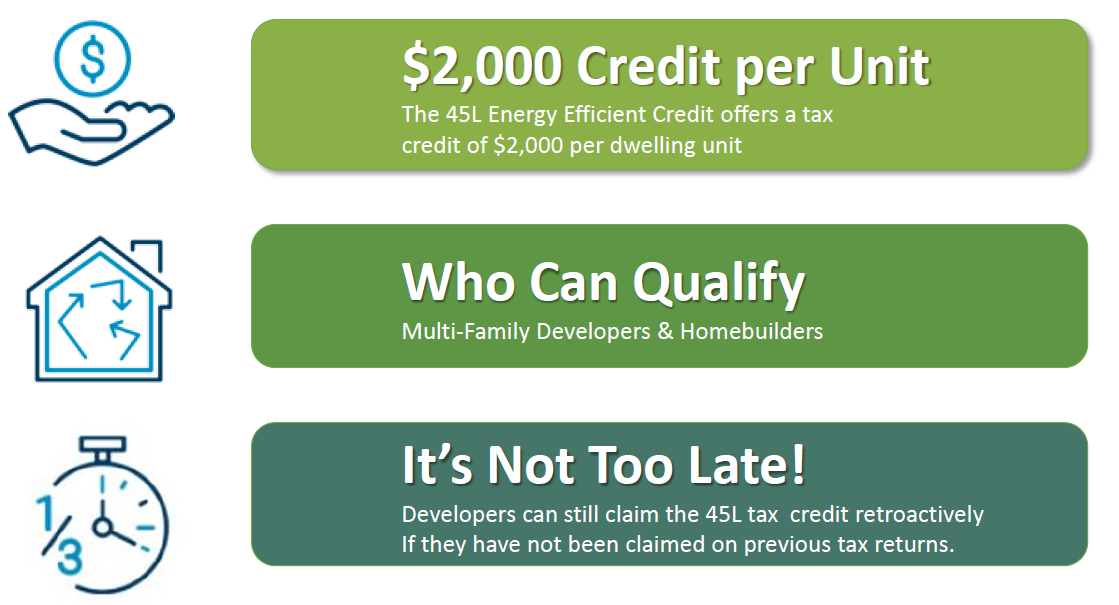

Single family homebuilders and multifamily developers can benefit from the 45L Tax Credit. The Energy Policy Act EPACT 45L tax credits of 2000 per qualified residential unit are back.

2021 Available Tax Incentives For Energy Efficiency Cova Green Homes

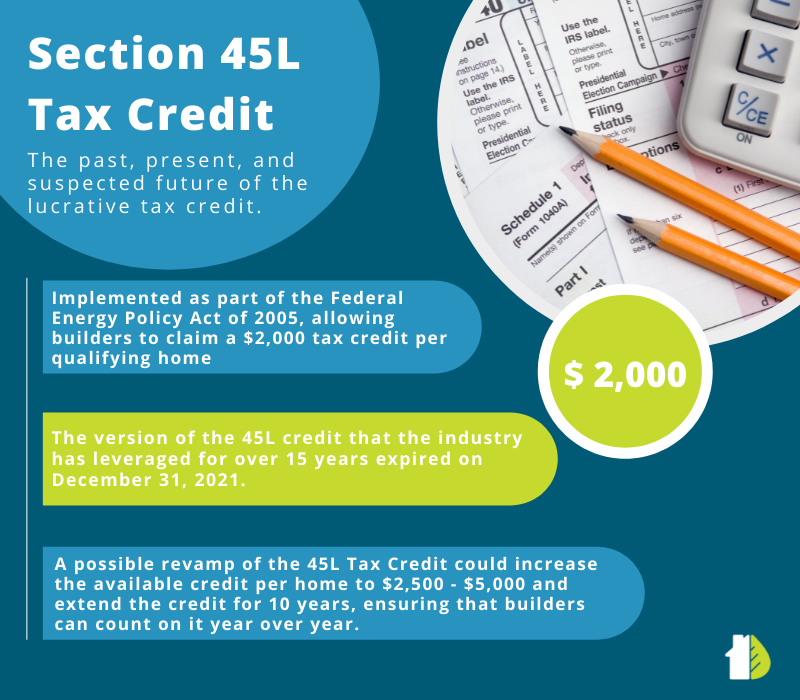

The 45L Tax Credit originally made effective on 112006 offers 2000 per dwelling unit to developments with energy consumption levels significantly less than certain national energy standards.

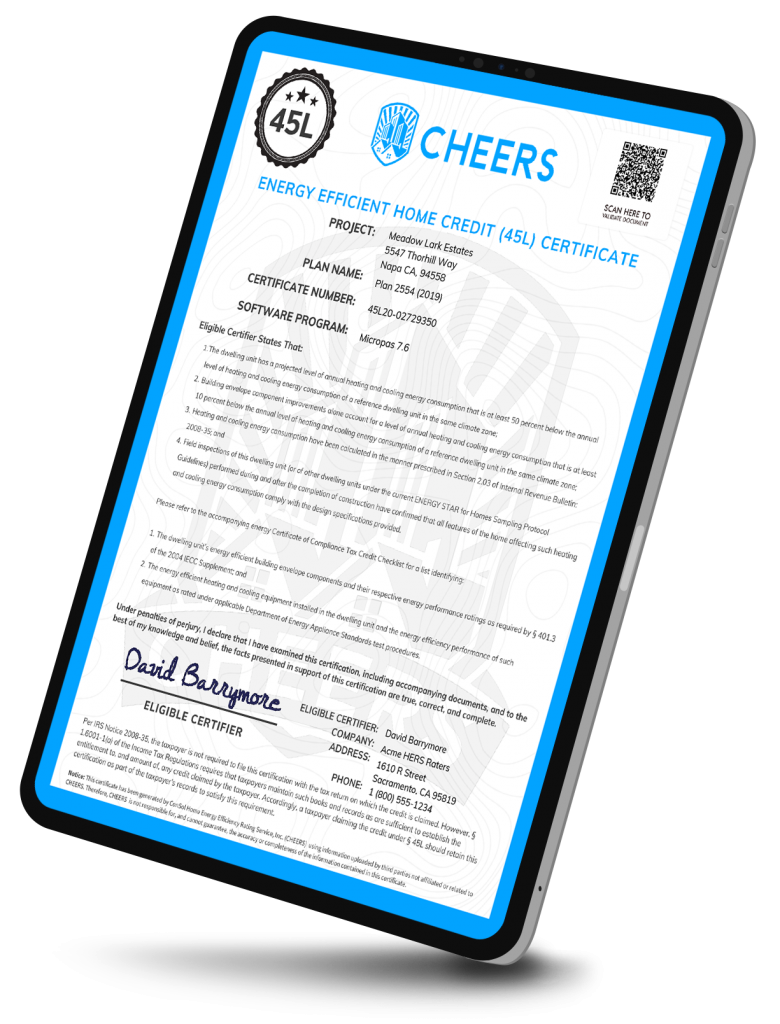

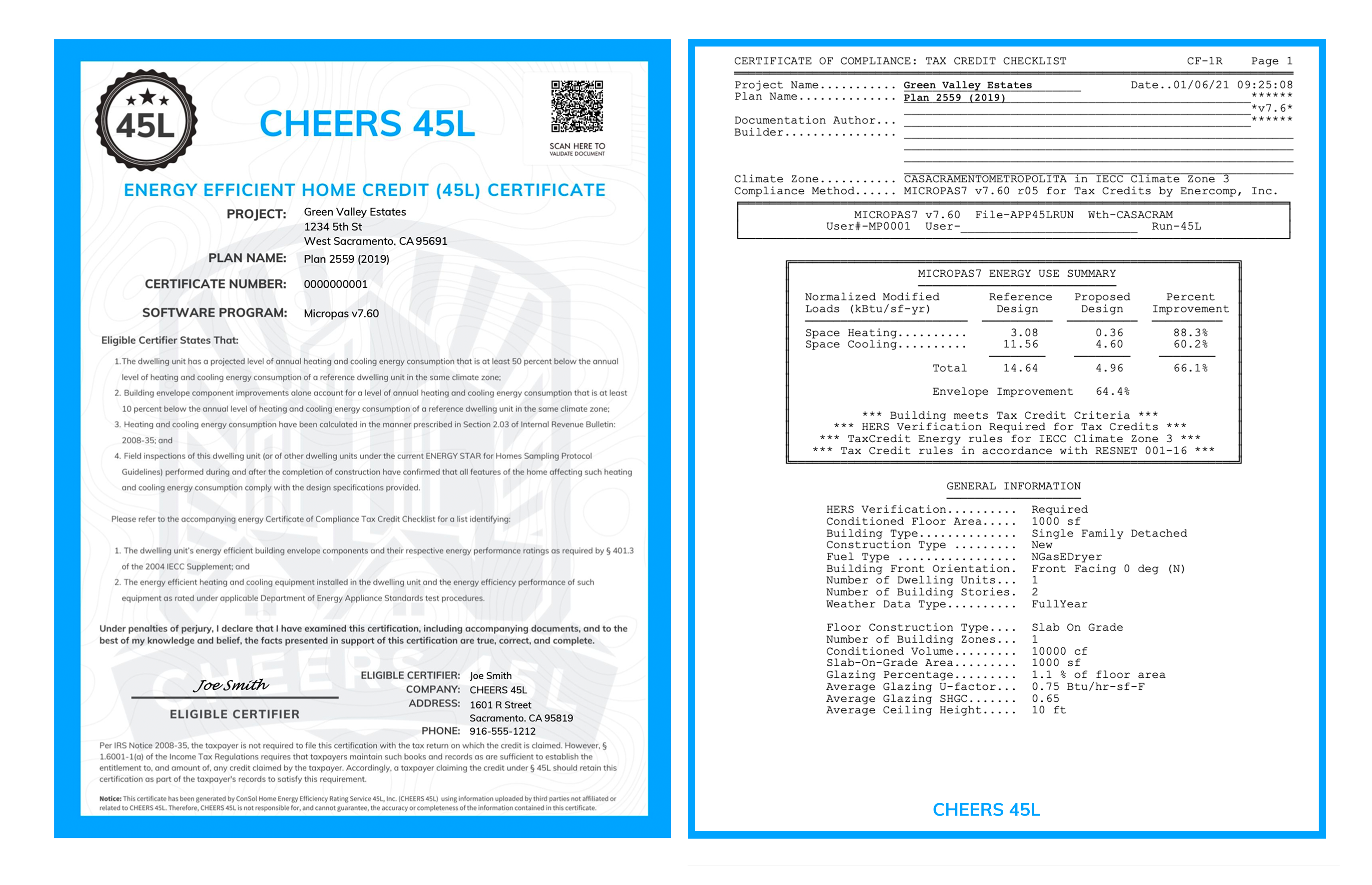

. Micropas is energy modeling software used to verify compliance with the energy efficiency requirements of the IRS 45L tax credit. 17 NEW BROOKLYN RD EDISON NJ 08817 Get Directions 732 885-2930. Developers that build or substantially renovate qualifying residential dwelling units that.

Our experts talk through the requirements and how you could benefit from Section 45L. Back to Top. Builder 2000home 45L Energy Efficient Tax Credit.

Browse reviews directions phone numbers and more info on Tax Credits LLC. Tax Credits Phone Number. The 45L energy-efficient residential tax credit was extended in 2019 and is in effect through the end of 2021.

Single family and multi-family projects which are three stories or less must demonstrate a 50 reduction in heatingcooling and a 10 energy reduction from the envelope when compared to the 2006 IECC. Micropas has been used by national builders throughout the country since the inception of the 45L tax credit in 2006. Any unused credits can be carried over for up to 20 years.

Homes and apartments must be at least 50 above the 2006 International Energy Conservation Code IECC. For qualified new energy efficient. With todays more stringent IECC 2018 code in effect most current construction will qualify.

Home energy features HVAC insulation etc must be verified by a. Free means free and IRS e-file is included. The 45L tax credit was intended to help buildersproperty owners claim around 2000 in tax credit for each energy-efficient home they construct or sell.

Our Most Comprehensive Monitoring ID Theft Protection Plan. Ad All Major Tax Situations Are Supported for Free. Available for single-family multi-family less than 3 stories homes sold 2017-2021.

Start Your Tax Return Today. Serving Over 1 Million Customers Worldwide. Recent tax legislation extended the Energy Efficient Home Credit to developers of energy-efficient homes and apartment buildings.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. 2000 per unit for new energy-efficient home. Claiming the Tax Credit.

The Inflation Reduction Act of 2022 introduced in the Senate yesterday July 28 2022 will expand and extend the 45L Energy Efficient Home Tax Credit. Purposes of obtaining a certification that satisfies the requirements of 45Ld. Get reviews hours directions coupons and more for Tax Credits at 45 Knightsbridge Rd Piscataway NJ 08854.

What are you looking for. Tax Credits LLC CLAIM THIS BUSINESS. Max refund is guaranteed and 100 accurate.

Congress extended the section 45L Tax Credit in December 2019 to encourage the construction industry to build and sell more high-performance homes. Homes must be 50 more efficient on heating cooling and hot water use than the IECC 2006 standards. Tax Credits Contact Details.

45L Tax Credit Requirements. BACKGROUND 01 In General. Ad Equifax Complete Premier.

Dec 20 2019. The bill extends the 45L energy credit for 10 years through 2032 and retroactively extends for this year 2022. Search for other No Internet Heading Assigned in Piscataway on The Real Yellow Pages.

Code 45L - New energy efficient home credit. Tax Credits Driving Directions. The credit was extended by the Consolidated Appropriations Act 2021 and applies to residences sold or leased on or before December 31 2021.

What kinds of projects are eligible. 45 Knightsbridge Rd Ste 22 Piscataway NJ 08854 Service Offerings. The tax credit was retroactively extended to include 2018 and 2019.

Find Tax Credits Location Phone Number and Service Offerings. 6 Often Overlooked Tax Breaks You Wouldnt Want to Miss. See Your Credit Score Equifax Credit Report.

Business profile of Tax Credits LLC located at 45 Knightsbridge Road 22 Piscataway NJ 08854. These valuable credits are overlooked due to a lack of understanding about the qualification process. Through recent passage of a new tax extenders bill the energy efficient home credit the 45L credit which provides eligible contractors with a 2000 tax credit for each energy efficient dwelling unit is retroactively available for projects placed in service from 2018 to 2020 and through the end of 2021.

Developed by Enercomp Inc. Learn More at AARP. The 45L tax credit provides developers of energy efficient homes.

After the detailed energy study has been certified and documented IRS Form 8908 is to be filed by the developer during the service year to claim the tax credit. What are the energy efficiency requirements for the 45L tax credit. Section 45L provides a credit to an eligible contractor who constructs a qualified new energy efficient home.

The program was also made retroactive meaning homes built. Contacts Gina Andrew. Guidance relating to manufactured homes will be provided in a separate notice.

Meets the requirements of paragraph 1 applied by substituting 30 percent for 50 percent both places it appears therein and by substituting ⅓ for ⅕ in subparagraph B thereof or. The maximum credits per dwelling unit are. The energy-efficient home credit provides developers a tax credit of up to 2000 per qualifying unit if they can certify the energy-saving qualities of the residence.

The bill also increases the 45L credit to 2500 per unithome. The efficiency requirements remain unchanged from the original tax credit program.

A Message For Earth Day Tax Credits That Work To Save The Environment

Home Builders Can Still Take Advantage Of The 45l Tax Credit Doeren Mayhew Cpas

Contractors Securing Work With The 45l Tax Credit Aeroseal

45l Tax Credit Energy Efficient Tax Credit 45l

45l Tax Credit Services Using Doe Approved Software

Section 45l Energy Tax Credit Past Present And Future Ekotrope

45l Tax Credit What Is The 45l Tax Credit Who Qualifies

What Is The 45l Tax Credit Get 2k Per Dwelling Unit We Can Help

45l The Energy Efficient Home Credit Extended Through 2017

45l Energy Efficient Tax Credits Engineered Tax Services

The 45l Tax Credit Is Expiring Again Cheers 45l

45l Tax Credit Overview And Analysis Of The Residential Efficiency Energy

Federal Energy Tax Credits 45l Are Back Energy Consulting Tax Credits Energy Conservation

45l Tax Credit Extended For 2021 Homes Ducttesters Inc

The 2 000 45l Efficiency Tax Credit What You Need To Know Attainable Home